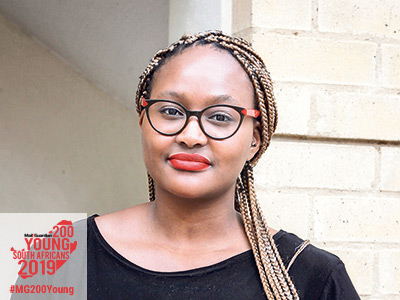

Refilwe Mashale is the group tax manager at multinational conglomerate Reunert Limited. Reunert manages a portfolio of over 40 businesses in the fields of electrical engineering, information and communication technologies and applied electronics. As its group tax manager, Mashale is expected to perform under tight deadlines.

In 2018 Mashale was appointed to establish an international tax practice at Reunert, to meet the needs of the multinational group’s long-term expansion strategy. Her background includes experience within the tax practices of both Big Four accounting firms and Big Five law firms in South Africa.

Mashale is active in the tax community, chairing and speaking at tax conferences and industry platforms, and publishing technical expert contributions locally and internationally.

Mashale’s passion for tax has led her to pursue an Advanced Diploma in International Taxation and she is currently completing her final examination. It is a global qualification issued by the Chartered Institute of Taxation in the United Kingdom. The qualification is held by only 1 000 international tax practitioners globally.

Mashale’s academic proficiency and professional skills are further complimented by her business acumen. She owns The Balloon Café, a start-up business she was inspired to establish in 2016 after working with venture capitalist firms at Edward Nathan Sonnenbergs, where she sought advice in implementing unconventional and creative business strategies to secure tax-efficient investments.

The Balloon Café, which employs four people, is an express helium balloon delivery service supplying various types of helium balloons. The business services a niche consumer market with professional, customised balloon decor installations and photography services.

Mashale is a strong advocate for young professionals to use their skills and expertise to advance South Africa. Putting her beliefs into action, she personally mentors several younger women, providing academic and career coaching as well as assistance in resolving issues of historic debt at tertiary level.